Please refer to important disclosures at the end of this report

1

Bharat Road Network Ltd (BRNL), is a BOT company, which is focused on

development, implementation, operation and maintenance of roads and highway

projects. The company manages over `6,685cr of road assets including five

operating projects and one under construction project aggregating to 2,

095 lane

km, with average residual life of approximately 18 years and 6 months.

Portfolio of roads across India: BRNL has a project each in Ke

rela, Madhya

Pradesh, Haryana, UP and Odisha and one more project is under

implementations in Maharashtra. While all the five of the six projects are

operational, only two of them are under final CoD, and the balance three

are

under provisional CoD. With f

inal CoD coming for the other projects the revenue

visibility could improve to some extent.

Weak reported financials: Only two

of BRNL’s projects are under final CoD, 3 are

under provisional CoD, however, on receiving the final CoD it is likely that t

he

revenue growth of the company would accelerate. Though, we acknowledge the

fact that there are enough levers for revenue growth in the future, the reported

numbers of the operational projects look weak with revenue of `

14.9cr and

EBITDA of `6.8cr. At the net level, the company reported a loss of `73.9cr.

All the SPVs/ Subsidiaries have made losses in the last two years:

Post the

commencement of the commercial operations the subsidiaries and SPVs of BRNL

have not been making adequate cash flows

and in the last two years all of them

have been making losses. The combined losses of all of them at SPV level stood at

`

149.7cr for FY2017. While there is a possibility of financials improving with

higher traffic growth, continuous losses can put further

pressure on the financials

of BRNL.

Outlook Valuation:

BRNL is present only in the BOT project segment and lack of

presence in the EPC segment makes its highly dependent on the traffic growth

and price increase for improving its profitability. Though BRNL

’s projects are

spread across India, the past track record of the numbers doesn’t give enough

confidence about sharp improvement in the near term. At

the issue price band of

`195-205, the stock is offered at 2.6x its Pre Issue BV and 1.5x-1.6x its

Diluted

BV. Even established players like IRB,

with strong portfolios are trading at similar

valuations and hence,

we believe the issue price leaves limited scope for further

appreciation. Hence, we have a NEUTRAL rating on the issue.

Key Financials

Y/E March (` cr) FY2013 FY2014 FY2015

FY2016

F

Y2017

Operating Income 0.7 9.6 8.4

0.8

10.3

EBITDA (2.1) (0.1) (0.9)

(2.9)

2.1

Net profit (16.9) (60.8) (26.4)

(92.5)

(73.9

)

EPS (`) (16.9) (60.8) (26.4)

(92.5)

(13.5

)

Book Value (`) (1.1) 10.5 6.0

(66.9)

78.6

P/E NA NA NA

NA

NA

P/BV (x) NA 19.6 34.4

NA

2.6

RoE (%) NA NA NA

NA

NA

RoCE (%) NA NA NA

NA

NA

Source: Company, Angel Research; Note: Valuation ratios based on pre-

issue outstanding shares

and at upper end of the price band

Bharat

Road Network Ltd

IPO Note | INFRASTRACTURE

September 5, 2017

NEUTRAL

Issue Open: Sept 06, 2017

Issue Close: Sept 08, 2017

QIBs 75% of issue

Non-Institutional 15% of issue

Retail 10% of issue

Promoters 65%

Others 35%

Post Issue Shareholding Pattern

Post Eq. Paid up Capital:

`83.95

cr

Issue size (amount): *

`571

cr -**601 cr

Price Band:

`195

-205

Lot Size: 73 shares and in multiple

thereafter

Post-issue implied mkt. cap: *

`1,637

cr - **

`

1,721 cr

Promoters holding Pre-Issue: 100%

Promoters holding Post-Issue: 65.1%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Fresh issue:

2.93 c

r

Face Value:

`10

Present Eq. Paid up Capital:

`54.65

cr

Offer for Sale: NIL

Siddhart Purohit

+022 39357600, Extn: 6872

siddhart.purohit@angelbroking.com

BRNL | IPO Note

September 05, 2017

2

Company background

Bharat Road Network Ltd (BRNL) is a BOT company, focused on development,

implementation, operation and maintenance of roads and highway projects. The

company manages over `6,685cr of road assets including five operating projects

and one under construction project aggregating to 2,095 lane km, with average

residual life of approximately 18 years and 6 months.

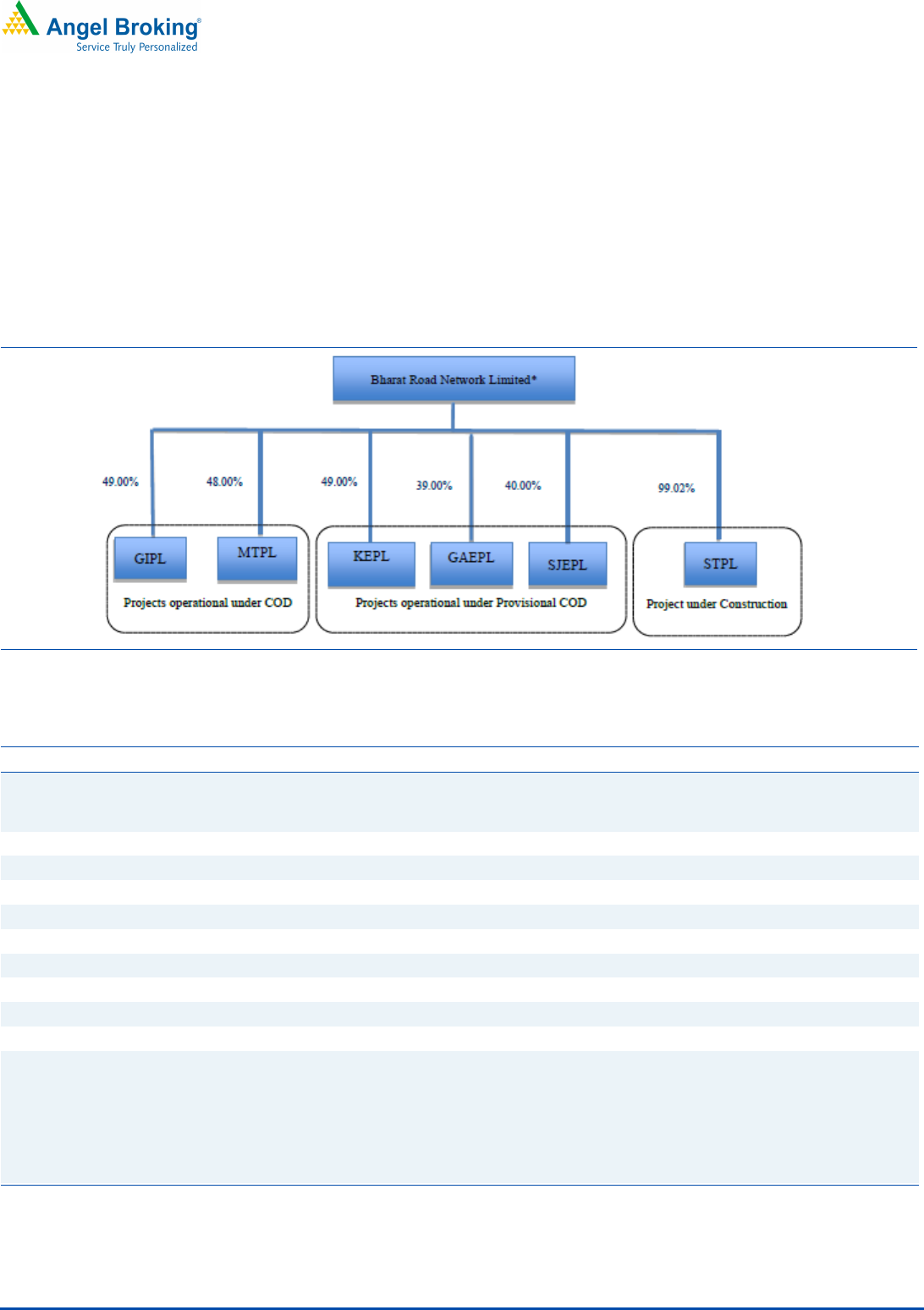

Exhibit 1: Corporate Structure/ Holding in various SPVs

Source: RHP, Angel Research

Exhibit 2: Project Details

GIPL

MTPL KEPL

GAEPL SJEPL

Current Status

Operational

Final COD

Operational

Final COD

Operational

Provisional COD

Operational

Provisional COD

Operational

Provisional COD

Design Length ( in Kms)

65.3

47.8 82.55

126.3 67

Actual Completed length

64.9

48.9 83.2

123.3 56.9

Actual Completed length in lane km 259.

8

195.6 332.6

493.2 341.3

Number of lanes

4

4 4

4 6

State

Kerala

Madhya Pradesh Haryana

Uttar Pradesh Odisha

Type of Project

Toll

Toll Toll

Toll Toll

Awarding Authority

NHAI

NHAI NHAI

NHAI NHAI

Dt of Sign of con Agr

March 27,2006

Sept,17,2008 May 10,2010

February 25,2011 December,14, 2011

Con period from appointed Dt 21 Yrs-9

Mn

25 Years 28 Years

24 Years 26 Years

Apx Residual Con life as FY17

11 Yrs & 2 months

17 Yrs & 2 months 22 Years & 1 month

17 Yr & 11 months 20 Yr & 8 months

Final COD Date/ Latest Prov COD

April,18,2016

February,17,2011 Sept,30,2014

Novermber,25,2016 January,12,2017

Total Estimated project Cost (` Cr)

649

341 993

1,708 1,774

Actual Project Cost Incurred upto

Final COD Date (` Cr)

721

330

1,024

1,925

1,803

Cost Overrun as of Final CoD (` Cr)

72

0 31

217 29

BRNL's Equity Stake in the SPVs (%)

49

48 49

39 40

Source: RHP, Angel Research

BRNL | IPO Note

September 05, 2017

3

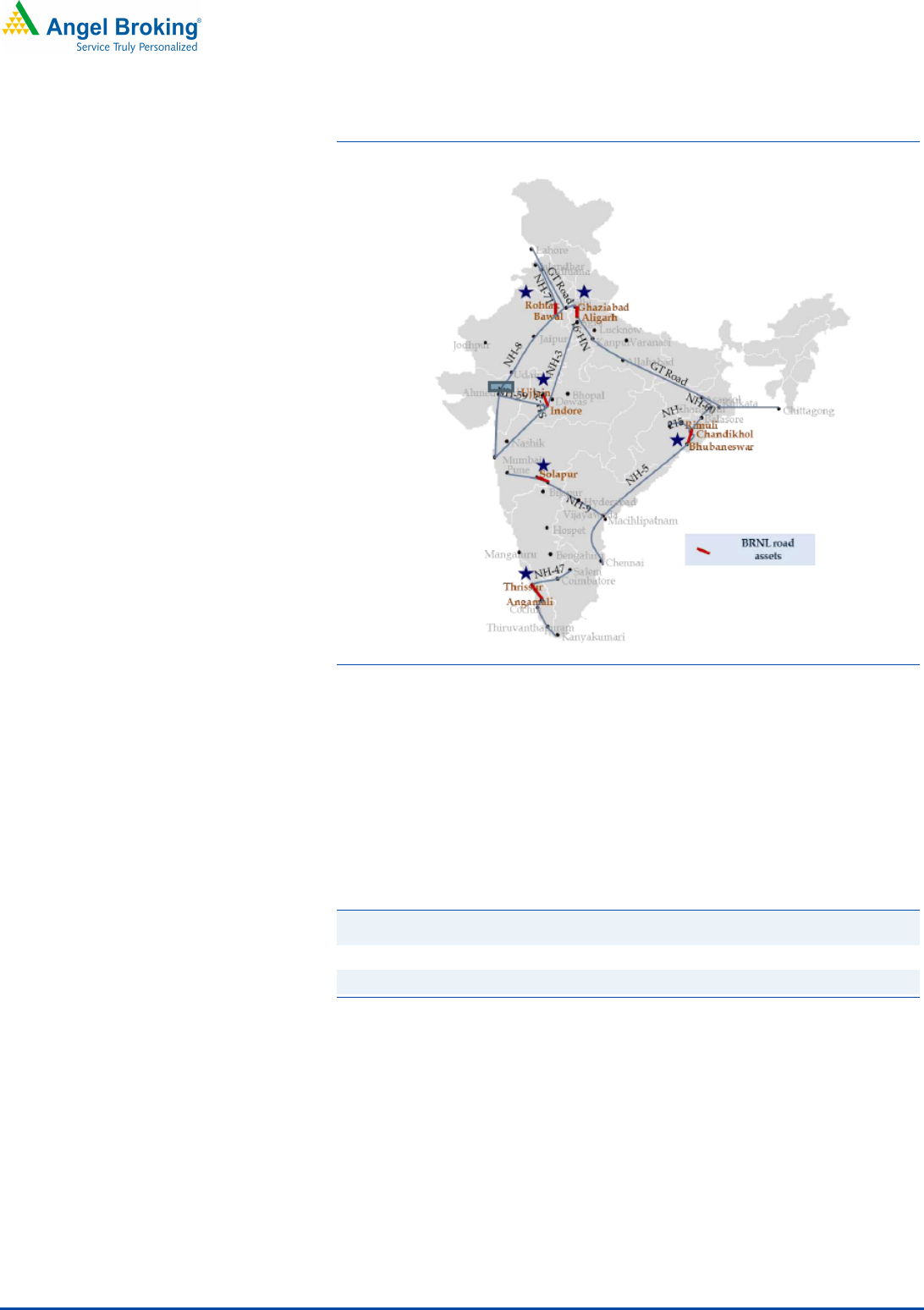

Exhibit 3: Project locations of BRNL

Source: RHP, Angel Research

Issue details

BRNL is offering 2.93cr equity shares of 10 each via book building route in price

band of `195-205/share, entirely comprising of fresh issue. There is no offer for

sale.

Exhibit 4: Pre and Post-IPO shareholding pattern

No. of shares (Pre-issue) (%) No. of shares (Post-issue)

(%)

Promoters

1.713 31.34 1.713

20.41

Promoter Group 3.752 68.66 3.752

44.67

Others 0.0 2.930

34.90

Source: RHP, Angel Research

BRNL | IPO Note

September 05, 2017

4

Exhibit 5: Top 1O Share holders Pre Issue

Name of Share holders No Of Shares % Holding

1.IPDC 2,09,50,000 38.3

2. SREI 1,66,30,000 30.4

3. OSPL Infradeal Private Limited 95,20,000 17.4

4. IPDF 70,49,800 12.9

5. Make in India Fund 5,00,000 0.9

6. Bajrang Kumar Choudhary 100 Negligible

7. Rajesh Sirohia 100 Negligible

Total 5,46,50,000 100

Source: RHP, Angel Research

Objects of the offer

Advancing of sub-ordinate debt in form of interest free unsecured loans to the

company’s subsidiary, STPL, to the tune of `51.47cr.

Acquisition of the sub-ordinate debt in the form of unsecured loans by SREI to

STPL, KEPL, MTPL, to the tune of `372.2cr.

BRNL | IPO Note

September 05, 2017

5

Investment rationale

Three projects under provisional CoD, final CoD will enhance the revenue

visibility: Currently, BRNL’s two out of five projects are under final CoD, while the

other three are under provisional CoD, with the final CoD of the other three, the

revenue visibility of the SPVs will also improve. However, going by the current run

rate of financials, the cash flows may not be adequate enough for rewarding

investors in the near term.

Exhibit 6: Project Status & Key Triggers

SPV Status Triggers

SJEPL Provisional COD to get Full COD Scope for higher tariff and volume growth

GAEPL

Provisional COD to get Full CoD Scope for higher tariff and volume growth

GIPL Operational COD

Moderate Growth in Traffic expected

KEPL Provisional COD to get Full COD Extension of Concession period

MTPL Operational COD

Moderate Growth in Traffic expected

Source: RHP, Angel Research

There has been cost overrun in projects earlier: In the past there has been delay in

project execution, sometimes though due to issues related to land acquisition.

While in some cases there is an extension of the concession period. Substantial

delay in future projects can impact the financials of the project and in turn of

BRNL’s profitability.

Exhibit 7: Cost overrun in projects

` cr GIPL MTPL KEPL GAEPL SJEPL

Estimated Project Cost on Financial Closure

649

341

993

1,708

1,774

Actual Project Cost incurred up to Final CoD/ March, 17

721

330

1,024

1,925

1,803

Cost Over Run

72

-

31

217

29

Source: RHP, Angel Research

BRNL | IPO Note

September 05, 2017

6

While we acknowledge the fact that final CoD of the three projects could enhance

revenue visibility, the Gross Toll Revenue and Operating EBITDA of the SPVs are

still weak

As mentioned earlier, while the final CoD might enhance the revenue visibility of

the respective SPVs. However, the SPVs, post commercial operations, both on Final

CoD/ Provisional CoD have been reporting losses in the last two years. Lack of

traffic growth and consequent lower cash flow could impact the profitability of the

SPVs/ Subsidiaries going ahead.

Exhibit 8: Revenue of SPVs

` Cr FY2014 FY2015 FY2016 FY2017

SJEPL NA NA NA 14

GAEPL NA NA 101 148

GIPL 92 106 117 119

KEPL 34 66 73 77

MTPL 21 22 19 23

Total 146 194 310 381

Source: RHP, Angel Research

Exhibit 9: Profit & Loss of Subsidiary & SPVs

Profit / (Loss) ` Cr

FY2015

FY2016 FY2017

SJEPL

NA

NA (1.1)

GAEPL

NA

(34.3) (51.4)

GIPL

33.1

(12.0) (10.9)

KEPL (65.8

)

(80.7) (71.5)

MTPL (20.6

)

(16.9) (14.8)

Total (53.3

)

(143.9) (149.7)

Source: Company, Angel Research

In the initial phase,

any BOT project might see higher interest and depreciation

cost, and hence,

absolute profitability at PAT level may not be the right way to

judge the performance, therefore

we have looked into the performance at the

EBITDA level, which too remains weak

Exhibit 10: Debt/ EBITDA (FY17 )

` Cr

EBITDA

Debt

Debt

/ EBITDA

SJEPL 12.

3

10,04.

0

81.4*

GAEPL 1,35.0

13,37.

0

9.9

GIPL 63.0

4,38.

8

7.0

KEPL 38.

9

7,41.

5

19.1

MTPL 12.

9

1,64.

8

12.7

Total 2,62.

1

36,86.1

14.1

Source: RHP, Angel Research

*The debt to EBITDA for SJEPL appears very high, as

the project has been

commissioned only in Jan, 2017.

BRNL | IPO Note

September 05, 2017

7

Details of the projects/ SPVs:

Guruvayoor Infrastructure Private Ltd (GPIL): The GIPL Project is for (a) four laning

of the existing two lane portion of Thrissur-Angamali section of NH-47 from km

270 to km316.7; (b) Improvement, operation and maintenance of the Angamali –

Edapalli section from km 316.7 to km 342 of NH 47 in Kerla on DCDFOM pattern

on BOT toll basis. The project has one operational toll plaza and it started

collecting toll from February 9, 2012. GIPL Project road is part of NH-47, which

originates at Kanyakumari and ends at Salem.

Concession Operator: The Company holds 49% stake in the GIPL project, while

the balance 51% stake is held by KMC Constructions Ltd and its associates.

Key Terms of the Concession: The concession was granted by NHAI. The term of

concession was 20 years and it was to start from September 22, 2006 and expire

on September 21, 2026. However, the same has been extended up to June 2028

due to delay in land acquisition by NHAI.

Exhibit 11: Traffic Movement of GIPL

GIPL FY13 FY14 FY15 FY16 FY17 FY18

ADT In PCU Terms

37,074

53,596

52,594

56,471

59,891

64,524*

% Growth YoY (1.9%) 7.4% 6.1% 7.7%

Source: RHP, Angel Research

ADT= Average Daily Traffic, PCU= Passenger Car Unit

*ADT for FY20

18 has been arrived by considering traffic number for the first two

months of FY2018 and YoY growth there on.

Mahakaleswar Tollways Private Ltd (MTPL): The MTPL project is for four laning of

the Indore-Ujjain portion from Ch-5/2 to Ch-53 on state highway 27 on a DBFOT

pattern, on a BOT toll basis in the state of Madhya Pradesh. The project has one

operational toll plaza, which started collecting toll from November, 20, 2010. The

Final COD was received on February 17, 2011.

MTPL Project Road is part of SH-27, which connects Rajasthan border in the north

and Maharashtra border in the south. On its way it connects the cities of Ujjain,

Indore & Pitampur.

Concession Operator: The Company holds 48% stake in the project, while Galfar

Engineering & Contracting S.O.AG holds 26% stake. Varaha Infra Ltd & Group

holds the balance stake.

Key Terms of the Concession: The concession was granted by MPRDC. The term of

the concession is 25 years starting from May 26, 2009 and expires in May 25,

2034.

Exhibit 12: Traffic Movement of MTPL

MTPL FY13

FY14

FY15 FY16 FY17 FY18

ADT In PCU Terms

13,365

13,754

15,750

15,863

15,570

16,355

% Growth YoY NA

2.9%

14.5% 0.7% -1.8%

Source: RHP, Angel Research

BRNL | IPO Note

September 05, 2017

8

Kurukshetra Expressway Way Pvt Ltd (KEPL): KEPL Project Road is part of NH-71,

which starts at Jalandhar and ends at NH-8 near Bawal. On its way it connects

Moga, Sangrur, and Rohtak. The concession agreement for the project was signed

on July, 13, 2010 and the latest Provisional CoD was received on September, 30,

2014. The residual concession period for the project is ~22 years & 1 month. The

traffic growth of the project has been lower in the last 3 years.

Exhibit 13: Traffic Movement of KEPL

KEPL FY14 FY15 FY16

FY17 FY18E

ADT In PCU Terms

21,468

21,115

20,872

20,167

23,902

% Growth YoY -1.6% -1.2%

-3.4% 18.5%

Source: RHP, Angel Research

Ghaziabad Aligarh Expressway Pvt Ltd (GAEPL): The GAEPL is located on the NH-

91, connects Ghazibad to Aligarh in U.P. Ghaziabd, part of the NCR is hub of

engineering electronics, leather and textile goods. Aligarh is located in the western

part of U.P at a distance of about 126 kms from Delhi. The GAEPL road project

connects several key cities including Ghazibad, Dadri, Sikandrabad, Aligarh.

The concession agreement for the project was signed on May, 10, 2010 and has a

residual concession period of ~17 years & 11 months. The latest provisional CoD

of the project was received on Nov, 25, 2016. The project witnessed a decent

6.6% growth in ADT in FY2017.

Exhibit 14: Traffic Movement GAEPL

FY16 FY17 FY18E

ADT in PCU Terms 24436 26042 28716

% Growth YoY in PCU terms NA 6.57 10.27

Source: RHP, Angel Research

Shree Jagannath Expressways Private Ltd (SJEPL): The SJEPL Project is located on

the NH-5 between Chandikhol and Bhubaneswar, Odisha. The end point of the

project road at Chandikhol is a major intersection, where NH-5A crosses NH-5

through overpass. NH-200 connects Daiteri Mines and then runs towards Raipur.

The concession agreement of the project was signed on August 6, 2010 and it has

a residual concession period of 20 years & 8 months. The 1

st

provisional CoD for

the project was received on January 12, 2017.

Exhibit 15: Traffic Movement SJEPL

FY14 FY15

FY16 FY17 FY18E

ADT in PCU Terms

37,427

35,934

38,692

43,287

45,100

% Growth YoY in PCU terms

(0.54) (3.99)

7.68 11.9 6.84

Source: RHP, Angel Research

BRNL | IPO Note

September 05, 2017

9

Solapur Toll Ways Private Ltd: STPL is a 99.02% subsidiary of BRNL, which is

undertaking the BOT project in Maharashtra. The scope of the project involves

augmenting the existing road by four laning the Solapur-Maharatsra/ Karnataka

border section of NH-9 from KM 249.0 to KM 348.80 KM in the state of

Maharashtra on DBFOT Toll Basis.

The estimated cost of the project is `882.62cr, while project cost incurred till March

31, 2017 stood at `473.3cr. The date of signing of concession agreement was

February, 29, 2012 and for approximate 22 years & 2 months.

Outlook & Valuation

BRNL is present only in the BOT project segment and lack of presence in the EPC

segment makes it highly dependent on the traffic growth and price increase for

improving its profitability. Though BRNL’s projects are spread across India, the

past track record of the numbers doesn’t give enough confidence about sharp

improvement in the near term.

At the issue price band of `195-205, the stock is offered at 2.6x its Pre Issue BV

and 1.5x-1.6x its Diluted BV. Even established players like IRB, with strong

portfolios are trading at similar valuations and hence, we believe the issue price

leaves limited scope for further appreciation. Hence, we have a NEUTRAL rating

on the issue.

Key Concerns:

Absence of EPC project and presence only in the BOT project segment makes

the company dependent on traffic growth and pricing for improving its

profitability.

BRNL | IPO Note

September 05, 2017

10

Exhibit 16: Income Statement ( Consolidated)

Y/E March (` cr) FY13 FY14 FY15

FY16 FY17

Total operating income 0.7 9.6 8.4

0.8 10.3

Total Expenditure 2.8 9.7 9.3

3.7 8.1

Operational Expenses 0.5 5.6 5.0

0.0 0.0

Employee Benefit Expenses 1.6 3.0 2.9

2.9 4.8

Other Expenses 0.6 1.1 1.4

0.8 3.3

EBITDA (2.1) (0.1) (0.9)

(2.9) 2.1

(% of Net Sales) (310.9) (0.6) (10.6)

(388.0) 20.8

Depreciation& Amortization 0.0 0.0 0.0

0.0 0.0

EBIT (2.1) (0.1) (0.9)

(2.9) 2.1

(% of Net Sales) (312.4) (0.6) (10.7)

(388.7) 20.7

Interest & other Charges 16.9 51.4 40.5

50.4 43.5

Other Income 2.4 0.0 33.1

3.5 4.7

Recurring PBT (16.6) (51.4) (8.4)

(49.8) (36.7)

% chg 2.1 (0.8)

4.9 -0.3

Tax 0.0 0.0 0.0

0.0 0.1

PAT -Before Profit loss of Associates

(16.6) (51.4) (8.4)

(49.8) (36.8)

% chg 2.1 -0.8

4.9 -0.3

Share of Loss of Associates 0.2 9.4 18.0

42.7 37.1

PAT (16.9) (60.8) (26.4)

(92.5) (73.9)

Source: RHP, Angel Research

BRNL | IPO Note

September 05, 2017

11

Exhibit 17: Balance Sheet ( Consolidated)

Y/E March (` cr)

FY13

FY14 FY15

FY16

FY17

SOURCES OF FUNDS

Equity Share Capital

10

10 10

10

54.7

Reserves& Surplus (11.1

)

0.5 (4.0) (76.9

)

375.1

Shareholders’ Funds (1.1

)

10.5 6.0 (66.9

)

429.8

Warrants

165.9

Share Application Money Pending Allotment

25

Minority Interest

31.44

Total Loans

298

461 567

885

568

Other Long Term Liabilities

0.1

2.6 8.1

7.6

18.5

Total Liabilities

322.1

474.1 581.0

826.1

1213.6

APPLICATION OF FUNDS

Tangible Assets

0.0

0.0 0.1

0.1

0.3

Intangible Assets

0.0

54.7 160.4

303.0

430.9

Goodwill on consolidation

0.0

1.5 1.5

1.5

1.9

Investments

320.5

374.0 381.2

361.0

454.7

Other Non Current Assets

0.0

25.9 72.2

131.4

286.9

Current Assets

6.6

59.7 13.5

39.8

57.7

Sundry Debtors

0.4

2.6 2.0

2.3

4.8

Cash

3.6

52.1 8.8

18.1

28.0

Loans & Advances

0.1

0.0 0.0

11.6

18.1

Other Assets

2.4

5.0 2.6

7.8

6.9

Current liabilities

5.1

41.8 48.0

10.7

18.8

Net Current Assets

1.5

17.9 (34.5)

29.1

39.0

Total Assets 322.

1

474.1 581.0

826.1

1213.6

Source: RHP, Angel Research

BRNL | IPO Note

September 05, 2017

12

Exhibit 18:

Y/E March (` cr) FY13 FY14 FY15

FY16 FY17

Profit before tax (16.6) (51.4) (8.4)

(49.8) (36.7)

Depreciation 0.0 0.0 0.0

0.0 0.0

Change in Working Capital 2.8 19.7 (30.6)

(31.0) (18.6)

Interest / Dividend (Net) 14.5 51.3 40.5

46.9 41.7

Direct taxes paid 0.0 (0.9) (0.8)

(1.1) (0.6)

Others 0.0 0.0 33.1

0.0 2.7

Cash Flow from Operations 0.7 18.8 (32.3)

(35.0) (17.0)

(Inc.)/ Dec. in Fixed Assets - (51.2) (100.5)

(142.8) (104.8)

(Inc.)/ Dec. in Investments (151.6) 9.5 (99.8)

(2.7) (158.3)

Cash Flow from Investing (295.7) (45.8) 37.8

(215.0) (163.0)

Issue of Equity 35.0 (25.0) 0.0

0.0 563.0

Inc./(Dec.) in loans 278.5 126.8 (180.6)

(39.6) (581.5)

Others 14.8 50.0 (150.8)

(303.4) (208.0)

Cash Flow from Financing 298.7 51.8 (29.8)

263.8 189.5

Inc./(Dec.) in Cash 3.7 24.8 (24.3)

13.8 9.6

Opening Cash balances 0.0 3.7 28.5

4.2 18.0

Closing Cash balances 3.7 28.5 4.2

18.0 27.6

Source: RHP, Angel Research

BRNL | IPO Note

September 05, 2017

13

Exhibit 19: Ratios

Y/E March (`) FY13 FY14 FY15

FY16 FY17

Valuation Ratio (x)

P/E NA NA NA

NA NA

P/CEPS NA NA NA

NA NA

P/BV NA 19.6 34.4

(3.1) 2.6

EV/Sales 721.4 220.3 244.3

707.2 278.4

EV/EBITDA NA NA NA

NA 1062

EV / Total Assets 6.3 4.5 3.9

3.1 1.9

Per Share Data (`)

EPS (Basic) (16.9) (60.8) (26.4)

(92.5) (13.5)

Cash EPS (16.9) (60.8) (26.4)

(92.5) (13.5)

Book Value (1.1) 10.5 6.0

(66.9) 78.6

Returns (%)

ROCE NA NA NA

NA NA

ROE NA NA NA

NA NA

Turnover ratios (x)

Inventory / Sales (days) NA NA NA

NA NA

Receivables (days) NA NA NA

NA NA

Payables (days) NA NA NA

NA NA

Source: RHP, Angel Research

BRNL | IPO Note

September 05, 2017

14

Research Team Tel: 022

-

39357800 E

-

mail: research@angelbroking.

com Website:

www.angelbroking.com

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

BRNL.

1. Financial interest of research analyst or Angel or his Associate or his relative No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives No

3. Served as an officer, director or employee of the company covered under Research No

4. Broking relationship with company covered under Research No